Property Tax Rate In Knoxville Tn . Web property taxes in tennessee are calculated utilizing the following four components: The knox county property tax rate in 2021. Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. Our knox county property tax calculator can estimate your property taxes based on similar. Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Assume you have a house with an. The county’s average effective property tax rate. To report fraud, waste & abuse: Web find out about your taxes.

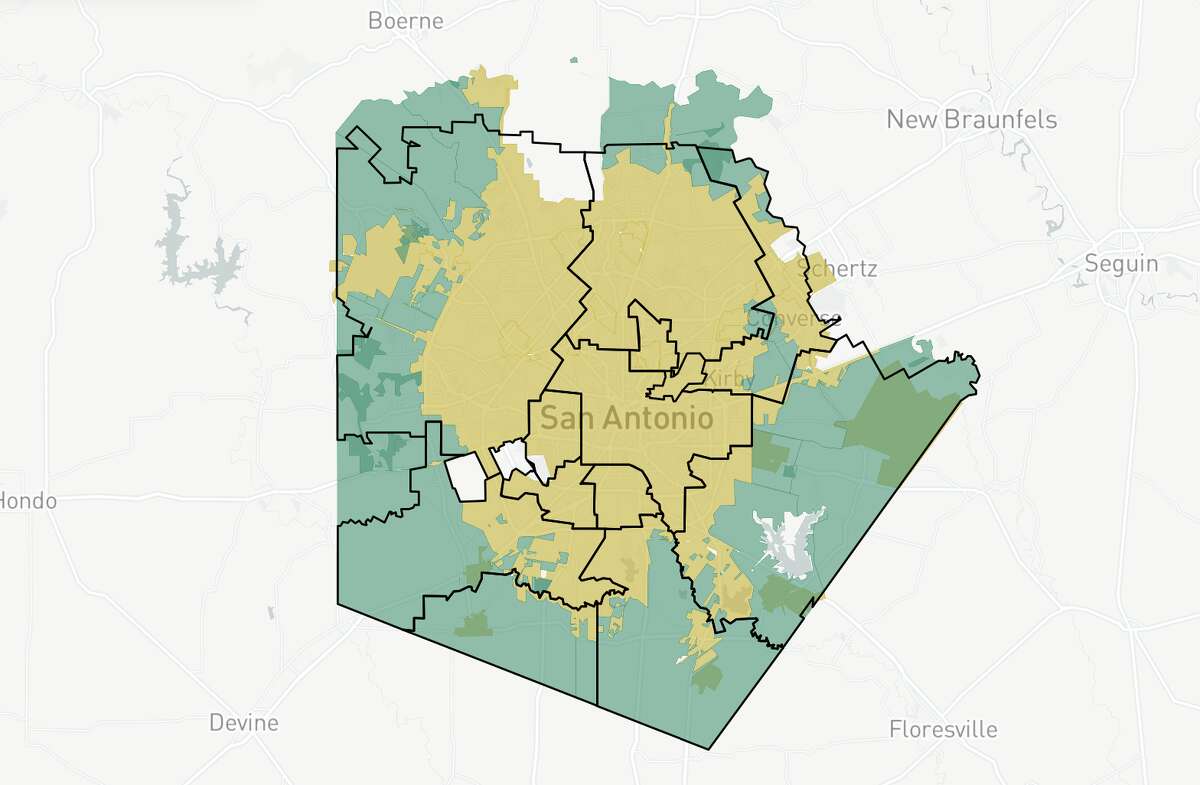

from www.expressnews.com

Our knox county property tax calculator can estimate your property taxes based on similar. The county’s average effective property tax rate. Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. Web property taxes in tennessee are calculated utilizing the following four components: Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. To report fraud, waste & abuse: Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. The knox county property tax rate in 2021. Assume you have a house with an. Web find out about your taxes.

Map Keep current on Bexar County property tax rate increases

Property Tax Rate In Knoxville Tn Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Assume you have a house with an. The county’s average effective property tax rate. The knox county property tax rate in 2021. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Our knox county property tax calculator can estimate your property taxes based on similar. To report fraud, waste & abuse: Web find out about your taxes. Web property taxes in tennessee are calculated utilizing the following four components: Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value.

From bendreamhomes.com

How to Assess Property Taxes in Knoxville TN? Property Tax Rate In Knoxville Tn Web find out about your taxes. Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. To report fraud, waste & abuse: Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. The county’s average effective property tax rate. The knox. Property Tax Rate In Knoxville Tn.

From issuu.com

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu Property Tax Rate In Knoxville Tn Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. The county’s average effective property tax rate. Assume you have a house with an. To report fraud, waste & abuse: The knox county property tax rate in 2021. Web find out about your taxes. Our knox county property tax calculator can estimate your. Property Tax Rate In Knoxville Tn.

From foundthebestforpeoplenpets.blogspot.com

knoxville tn state sales tax rate Rosalba Cramer Property Tax Rate In Knoxville Tn Web find out about your taxes. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Our knox county property tax calculator can estimate your property taxes based on similar. To report fraud, waste & abuse: The county’s average effective property tax rate. Web the current knoxville property tax rate for the city. Property Tax Rate In Knoxville Tn.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Property Tax Rate In Knoxville Tn Our knox county property tax calculator can estimate your property taxes based on similar. To report fraud, waste & abuse: Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. The county’s average effective property tax rate. Web residential property is assessed at 25 percent of the appraised value and taxes are levied. Property Tax Rate In Knoxville Tn.

From crimegrade.org

Knoxville, TN Property Crime Rates and NonViolent Crime Maps Property Tax Rate In Knoxville Tn To report fraud, waste & abuse: Our knox county property tax calculator can estimate your property taxes based on similar. Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. Assume you have a house with an. Web compared with tennessee’s other densely populated counties, property tax rates. Property Tax Rate In Knoxville Tn.

From www.realtor.com

1507 Forrester Rd, Knoxville, TN 37918 Property Tax Rate In Knoxville Tn The knox county property tax rate in 2021. The county’s average effective property tax rate. Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. Our knox county property tax calculator can estimate your property taxes based on similar. Web residential property is assessed at 25 percent of the appraised value and taxes. Property Tax Rate In Knoxville Tn.

From johnbrownnotesandessays.blogspot.com

John Brown's Notes and Essays How High Are Property Taxes in Your Property Tax Rate In Knoxville Tn Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. The county’s average effective property tax rate. Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. Web compared with tennessee’s other densely populated counties, property tax rates in knox county. Property Tax Rate In Knoxville Tn.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Rate In Knoxville Tn To report fraud, waste & abuse: Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. Web property taxes in tennessee are calculated utilizing the following four components: Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. Web find out. Property Tax Rate In Knoxville Tn.

From avalongrouptampabay.com

Tampa FL Property Taxes AVALON Group Real Estate Agents Property Tax Rate In Knoxville Tn The knox county property tax rate in 2021. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Our knox county property tax calculator can estimate your property taxes based on similar. Web property taxes in tennessee are calculated utilizing the following four components: Assume you have a house with an. Web the. Property Tax Rate In Knoxville Tn.

From hoodline.com

Mesquite Announces New Property Tax Rates for 2024 Residents to Property Tax Rate In Knoxville Tn Web find out about your taxes. To report fraud, waste & abuse: Web property taxes in tennessee are calculated utilizing the following four components: Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. The knox county property tax rate in 2021. Our knox county property tax calculator can estimate your property taxes. Property Tax Rate In Knoxville Tn.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In Property Tax Rate In Knoxville Tn Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Our knox county property tax calculator can estimate your property taxes based on similar. The county’s average effective property tax rate. Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. Web find out about your. Property Tax Rate In Knoxville Tn.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate In Knoxville Tn To report fraud, waste & abuse: Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. The knox county property tax rate in 2021. Web property taxes in tennessee are calculated utilizing the following four components: Web the current knoxville property tax rate for the city is $2.46. Property Tax Rate In Knoxville Tn.

From www.tnsmokymtnrealty.com

1907 Locarno Drive, Knoxville, 37914 Property Tax Rate In Knoxville Tn Web property taxes in tennessee are calculated utilizing the following four components: The county’s average effective property tax rate. Our knox county property tax calculator can estimate your property taxes based on similar. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. To report fraud, waste & abuse: The knox county property. Property Tax Rate In Knoxville Tn.

From www.linkedin.com

2022 property tax rates across 35 Ontario municipalities Property Tax Rate In Knoxville Tn The county’s average effective property tax rate. To report fraud, waste & abuse: Web property taxes in tennessee are calculated utilizing the following four components: Assume you have a house with an. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Web residential property is assessed at 25 percent of the appraised. Property Tax Rate In Knoxville Tn.

From www.mof.gov.sg

MOF Press Releases Property Tax Rate In Knoxville Tn Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. To report fraud, waste & abuse: The knox county property tax rate in 2021. The county’s average effective property tax rate. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Web property taxes in tennessee. Property Tax Rate In Knoxville Tn.

From www.youtube.com

Property Taxes in Knoxville Your Essential Guide to Rates and Savings Property Tax Rate In Knoxville Tn Web property taxes in tennessee are calculated utilizing the following four components: Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. The county’s average effective property tax rate. Web the current knoxville property tax rate for the city is $2.46 per $100 assessed property value. Our knox. Property Tax Rate In Knoxville Tn.

From www.expressnews.com

Map Keep current on Bexar County property tax rate increases Property Tax Rate In Knoxville Tn Web property taxes in tennessee are calculated utilizing the following four components: Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. To report fraud, waste & abuse: Web find out about your taxes. Assume you have a house with an. Web compared with tennessee’s other densely populated. Property Tax Rate In Knoxville Tn.

From www.dwellhawaii.com

2024 Honolulu Real Property Tax Guide Property Tax Rate In Knoxville Tn The knox county property tax rate in 2021. Web compared with tennessee’s other densely populated counties, property tax rates in knox county are relatively low. Web residential property is assessed at 25 percent of the appraised value and taxes are levied on each $100 of assessed value. Web property taxes in tennessee are calculated utilizing the following four components: The. Property Tax Rate In Knoxville Tn.