Barn Improvements Depreciation . Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. — can land improvements be depreciated? farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. — basic depreciation rules for farm assets. All farming and ranching equipment. — land improvements. It’s important to understand how tax depreciation for land. The first part of this chapter gives you basic information on what property can be depreciated, when.

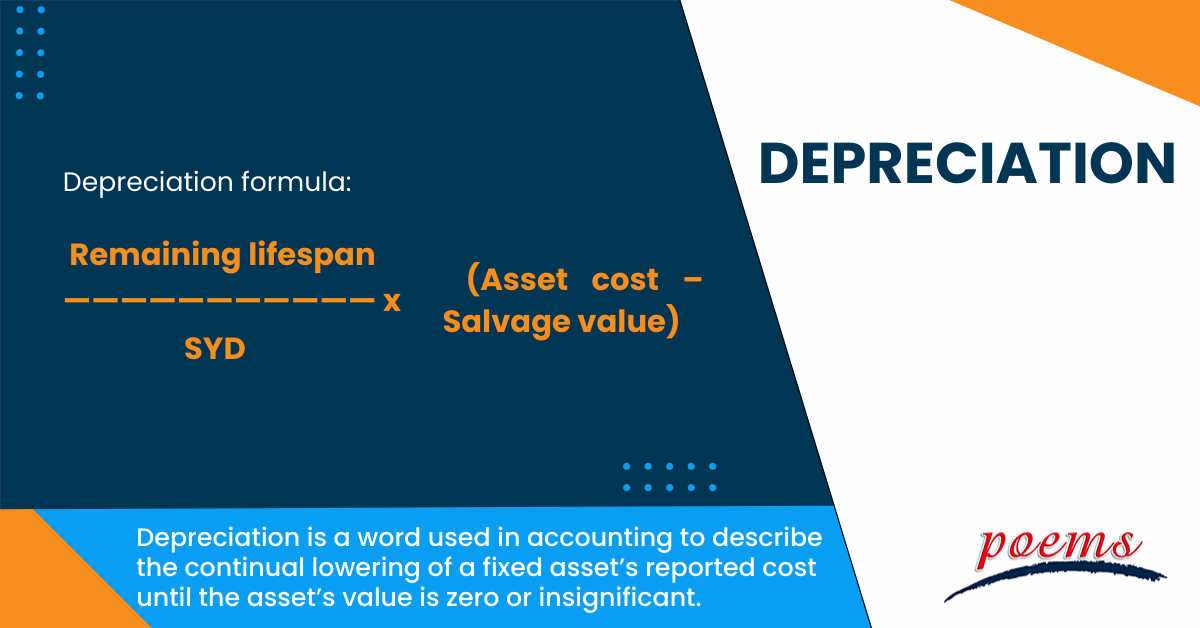

from www.poems.com.sg

— land improvements. It’s important to understand how tax depreciation for land. — can land improvements be depreciated? The first part of this chapter gives you basic information on what property can be depreciated, when. All farming and ranching equipment. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. — basic depreciation rules for farm assets.

Drepreciation What is it, Types , Calculation, Examples, FAQ

Barn Improvements Depreciation It’s important to understand how tax depreciation for land. All farming and ranching equipment. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. — can land improvements be depreciated? It’s important to understand how tax depreciation for land. — land improvements. — basic depreciation rules for farm assets. The first part of this chapter gives you basic information on what property can be depreciated, when.

From www.slideserve.com

PPT Chapter 10 Depreciation PowerPoint Presentation, free download Barn Improvements Depreciation farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. — basic depreciation rules for farm assets. — land improvements. — can land improvements be depreciated? Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. All farming and ranching equipment. It’s important to understand how tax depreciation for. Barn Improvements Depreciation.

From www.irstaxapp.com

Depreciation MACRS Table for Asset's Life Internal Revenue Code Barn Improvements Depreciation Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. The first part of this chapter gives you basic information on what property can be depreciated, when. — land improvements. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. — basic depreciation rules for farm assets. All farming and. Barn Improvements Depreciation.

From lakeishaaliha.blogspot.com

Farm equipment depreciation calculator LakeishaAliha Barn Improvements Depreciation farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. All farming and ranching equipment. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. — land improvements. — can land improvements be depreciated? The first part of this chapter gives you basic information on what property can be depreciated,. Barn Improvements Depreciation.

From www.freepik.com

Premium Vector Four main type of depreciation methods to calculate Barn Improvements Depreciation farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. — land improvements. All farming and ranching equipment. The first part of this chapter gives you basic information on what property can be depreciated, when. — basic depreciation rules for. Barn Improvements Depreciation.

From www.scheduletemplate.org

9 Free Depreciation Schedule Templates in MS Word and MS Excel Barn Improvements Depreciation — basic depreciation rules for farm assets. — can land improvements be depreciated? Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. All farming and ranching equipment. The first part of this chapter gives you basic information on what property can be depreciated, when. farmers are required to calculate depreciation expense using the. Barn Improvements Depreciation.

From www.calt.iastate.edu

Using Percentage Tables to Calculate Depreciation Center for Barn Improvements Depreciation It’s important to understand how tax depreciation for land. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. The first part of this chapter gives you basic information on what property can be depreciated, when. — can land improvements be depreciated? — land improvements. All farming and ranching equipment. farmers are required to. Barn Improvements Depreciation.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Barn Improvements Depreciation Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. It’s important to understand how tax depreciation for land. — can land improvements be depreciated? farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. The first part of this chapter gives you basic information on what property can be depreciated,. Barn Improvements Depreciation.

From www.examples.com

Depreciation Schedule 6+ Examples, Format, How to Build, Pdf Barn Improvements Depreciation farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. The first part of this chapter gives you basic information on what property can be depreciated, when. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. It’s important to understand how tax depreciation for land. All farming and ranching equipment. . Barn Improvements Depreciation.

From brookenella.blogspot.com

Irs vehicle depreciation calculator BrookeNella Barn Improvements Depreciation — can land improvements be depreciated? All farming and ranching equipment. — land improvements. The first part of this chapter gives you basic information on what property can be depreciated, when. — basic depreciation rules for farm assets. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. farmers are required to calculate. Barn Improvements Depreciation.

From accounting-services.net

Depreciation Recapture Definition ⋆ Accounting Services Barn Improvements Depreciation — basic depreciation rules for farm assets. — can land improvements be depreciated? farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. — land improvements. The first part of this chapter gives you basic information on what property can be depreciated, when. All farming and ranching equipment. It’s important to understand. Barn Improvements Depreciation.

From www.youtube.com

How to Implement MACRS Depreciation Method + Example YouTube Barn Improvements Depreciation All farming and ranching equipment. — land improvements. The first part of this chapter gives you basic information on what property can be depreciated, when. — basic depreciation rules for farm assets. — can land improvements be depreciated? farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. Improvements such as pavement,. Barn Improvements Depreciation.

From www.chegg.com

Solved Required For each asset classification, prepare a Barn Improvements Depreciation farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. The first part of this chapter gives you basic information on what property can be depreciated, when. It’s important to understand how tax depreciation for land. — land improvements. All farming and ranching equipment. — basic depreciation rules for farm assets. —. Barn Improvements Depreciation.

From www.findwordtemplates.com

Depreciation Schedule Samples Find Word Templates Barn Improvements Depreciation — land improvements. — can land improvements be depreciated? farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. — basic depreciation rules for farm assets. All farming and ranching equipment. It’s important to understand how tax depreciation for. Barn Improvements Depreciation.

From es.cs-finance.com

Depreciación de mejoras de suelo Los Basicos 2023 Barn Improvements Depreciation All farming and ranching equipment. — can land improvements be depreciated? — basic depreciation rules for farm assets. The first part of this chapter gives you basic information on what property can be depreciated, when. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. It’s important to understand how tax depreciation for. Barn Improvements Depreciation.

From www.slideserve.com

PPT Depreciation PowerPoint Presentation, free download ID206489 Barn Improvements Depreciation — can land improvements be depreciated? All farming and ranching equipment. — land improvements. The first part of this chapter gives you basic information on what property can be depreciated, when. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. — basic depreciation rules for farm assets. farmers are required to calculate. Barn Improvements Depreciation.

From www.slideserve.com

PPT Depreciation PowerPoint Presentation, free download ID206489 Barn Improvements Depreciation Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. The first part of this chapter gives you basic information on what property can be depreciated, when. All farming and ranching equipment. — basic depreciation rules for farm assets. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. —. Barn Improvements Depreciation.

From www.moneybarn.com

Motoring Depreciation Moneybarn Barn Improvements Depreciation — basic depreciation rules for farm assets. Improvements such as pavement, reservoirs, dikes, and other depreciable improvements to land are. It’s important to understand how tax depreciation for land. — land improvements. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. All farming and ranching equipment. — can land improvements be. Barn Improvements Depreciation.

From www.poems.com.sg

Drepreciation What is it, Types , Calculation, Examples, FAQ Barn Improvements Depreciation — can land improvements be depreciated? — land improvements. farmers are required to calculate depreciation expense using the modified accelerated cost recovery system. It’s important to understand how tax depreciation for land. The first part of this chapter gives you basic information on what property can be depreciated, when. Improvements such as pavement, reservoirs, dikes, and other. Barn Improvements Depreciation.